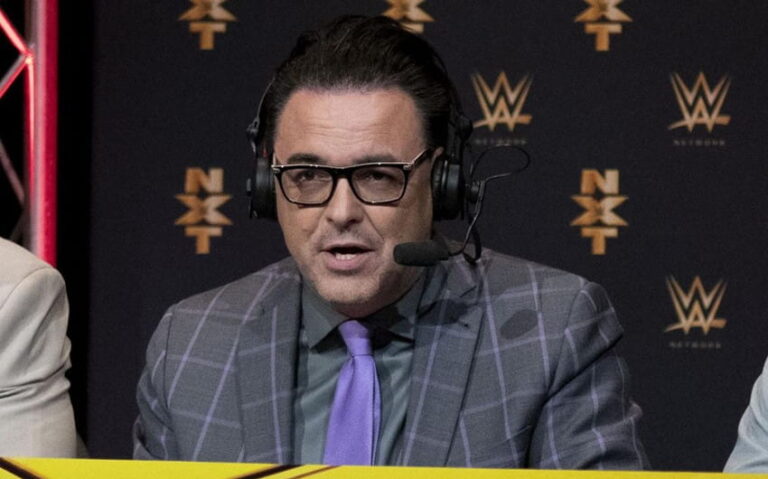

Jim Jordan’s Net Worth in 2026: What Disclosures Reveal About His Finances

Jim Jordan’s net worth gets exaggerated online all the time, mostly because people confuse “famous” with “wealthy.” The reality is far more grounded. Based on his official financial disclosures, Jordan’s publicly reported assets look modest for a long-serving member of Congress—likely in the mid-six figures (excluding his home, which disclosure rules generally don’t require). Once you know where to look, the story becomes clear: steady government salary, retirement benefits, and occasional book royalties—not a hidden fortune.

Start with the only source that really matters: financial disclosures

If you want the cleanest view of a sitting member of Congress’s finances, you don’t start with random “net worth” websites. You start with the House financial disclosure reports. These filings don’t show every dollar and they don’t read like a tax return, but they do show the broad outlines: assets reported in value ranges, certain income categories, and liabilities (if any are disclosed). They also come with a major limitation that people overlook: a primary residence is typically not listed as an asset in the same way investments are, so a politician can appear “less wealthy” on paper than their household actually is.

That said, Jim Jordan’s disclosures tell a consistent story over time: retirement accounts and bank accounts make up the bulk of what’s visible, with some intellectual property royalties tied to books.

What his 2024 filing shows (filed in 2025)

Jordan’s 2024 annual financial disclosure (filed in 2025) lays out the pieces in plain language. The reported assets include:

- Park National Bank accounts listed in ranges, including one account in the $50,001 to $100,000 range and another in the $15,001 to $50,000 range.

- Ohio Public Employees Retirement System defined benefit plan shown in a $100,001 to $250,000 range (with other retirement entries listed as “undetermined” rather than given a value range).

- Intellectual property royalties tied to his book Do What You Said You Would Do and an older sports nutrition book credit, with royalty income reported in smaller annual ranges.

- No liabilities disclosed on that filing.

What does that add up to in real-world terms? If you use only the values that are actually given ranges and ignore everything marked “undetermined,” you can reasonably place his disclosure-based assets in a broad band that often lands somewhere like $265,000 to $650,000 before you even argue about anything else. That isn’t a “gotcha”—it’s just what the ranges imply when you do basic math. And because defined-benefit pensions can be difficult to value from the outside (especially when listed as “undetermined”), the true long-term value could be higher, but it’s not the same thing as a liquid investment portfolio sitting in a brokerage account.

What his 2022 filing shows (filed in 2023) and why it matters

His 2022 annual disclosure (filed in 2023) paints a similar picture but includes a detail that helps explain why the internet swings between “he’s broke” and “he’s secretly rich.” In that filing, the book royalties for Do What You Said You Would Do appear with a reported income range that can be large in that year. In other words: one-time or occasional income spikes can make headlines, even when the underlying asset picture remains relatively plain.

That’s how net worth myths are born. Someone sees “book royalties” and assumes it means a permanent multimillion-dollar income stream. In reality, publishing money can show up in uneven waves—advance timing, payout schedules, and release-year spikes—and then flatten out. A year with strong royalty reporting does not automatically translate into a massive net worth, especially when the rest of the disclosure reads like a typical long-serving public official: retirement systems and bank accounts.

So what is Jim Jordan’s net worth in 2026?

Here’s the confident, responsible way to say it:

Estimated Jim Jordan net worth in 2026: roughly $250,000 to $750,000 based on disclosure-visible assets, with additional value likely tied up in pension benefits and a home not fully reflected in the filings.

This range is the most realistic because it matches what the official filings actually show: moderate liquid assets, retirement benefits, and limited outside income streams. It also lines up with disclosure-based summaries that have put him in the “modest by Congress standards” category rather than the “multimillionaire investor” category.

Could someone argue a slightly higher or lower number? Sure, because disclosures are range-based, pensions are hard to price precisely, and real estate isn’t fully visible. But the general conclusion doesn’t change: the public record supports “mid-six-figure household finances,” not “secret mogul money.”

Where his money actually comes from

Jim Jordan’s finances make the most sense when you look at the few income lanes available to him.

1) Congressional salary

The base salary for rank-and-file members of Congress has been $174,000 for years (and pay raises are frequently blocked). That salary is strong compared to most jobs in the U.S., but it is not “get rich quick” money—especially when you consider the reality of maintaining two locations (Washington and home district) and the costs that come with a public life.

If you want to understand why his disclosures don’t look like a hedge fund manager’s portfolio, start here: a congressional salary can build a comfortable life over time, but it rarely builds a massive fortune unless paired with major outside investments, business ownership, or inherited wealth.

2) Retirement benefits tied to earlier employment

Jordan has retirement system entries tied to earlier work in Ohio public employment. For a long-serving public official, retirement benefits can represent meaningful long-term value, but they don’t behave like a stock account. They are not instantly liquid, and their value depends on rules, service years, and payout structures. That’s why some of these plans are shown as “undetermined” in disclosures: they don’t fit neatly into a simple “this is worth exactly X today” box.

3) Book royalties and intellectual property

The filings show royalty arrangements connected to publishing. This is the flashiest part of the story because it’s the part people can sensationalize. But the more useful way to read it is practical: a politician with a national profile can earn extra income from books, and that income may spike around release windows.

It’s also worth noting what you don’t see: there’s no visible pattern of aggressive stock trading disclosures, no sprawling list of rental properties, and no disclosed liabilities in the later filing that would hint at a highly leveraged business life. The public record reads like a public servant with a few extra income lanes—not a real estate baron.

Why the internet throws around crazy numbers

Once you know what the disclosures look like, the wild net worth claims start to look almost silly. Here’s why those numbers spread anyway:

- “Net worth” sites copy each other and often publish guesses without a clear methodology.

- People confuse income with net worth. A strong year of royalties can look like permanent wealth.

- Primary homes aren’t clearly listed as assets in the same way investments are, which makes disclosures look “smaller” than a full household balance sheet.

- Defined-benefit pensions are hard to value precisely from the outside, so some sites inflate the number while others ignore it entirely.

The result is a familiar online mess: one website claims he’s worth a few hundred thousand, another claims he’s worth tens of millions, and neither explains the difference in a way that matches public records. When you anchor the discussion to disclosures, the fog clears.

The clean takeaway for readers

Jim Jordan’s finances are not a mystery, and they aren’t exotic. The public record points to a long-time member of Congress with modest disclosed assets concentrated in retirement accounts and bank accounts, plus some book-related income. That supports a net worth conversation measured in hundreds of thousands rather than the inflated “$20 million” or “$30 million” claims that bounce around the internet.

In other words: his wealth story is a public-service wealth story. Steady salary. Retirement benefits. Occasional publishing income. And a personal financial footprint that looks far more ordinary than his national profile would make you think.

image source: https://edition.cnn.com/2023/03/04/politics/jim-jordan-fbi-employees-whistleblowers